Authentifizierung & Banking

auch auf potenziell unsicheren Systemen

Unser Thema ist die Sicherheit und Härtung von Bank- und Authentifizierungsprozessen. CORONIC ist Marktführer bei der Trojanerabwehr und dem Verhindern von Phishing-Angriffen auf das Browser-Banking von Privatkunden deutscher Banken.

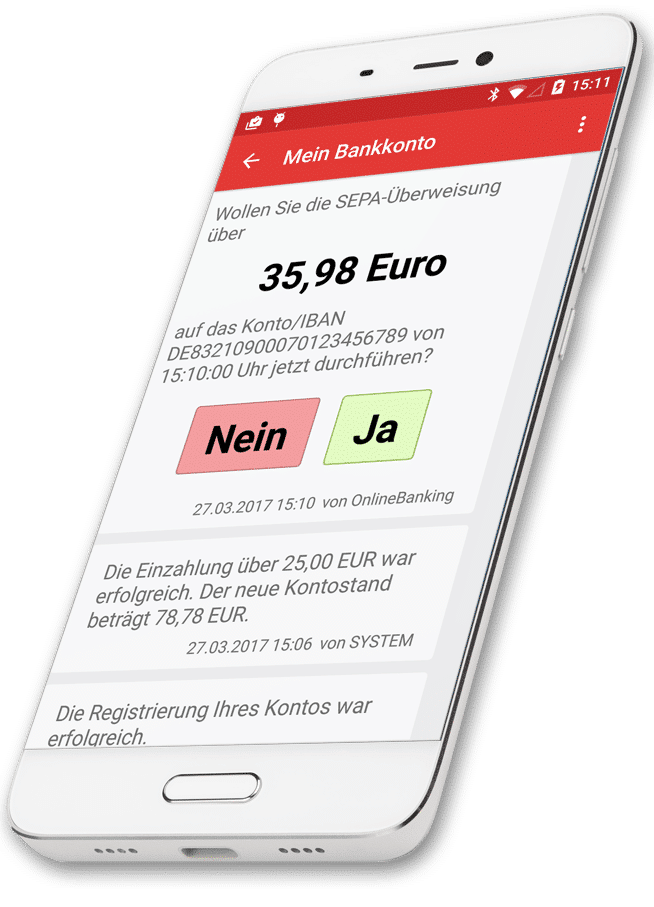

Fingerabdruck, Foto und der Klang der Stimme sind seit jeher Merkmale der persönlichen Identität. Mit SIGN werden Fingerprint und FaceID zu BaFin-konformen Merkmalen im Banking. Umsatzanzeige ohne extra TAN, Überweisung per Fingerabdruck und Login ohne statische Wissensmerkmale – alles mit PSD2/RTS-Freigabe.

Das CORONIC Security Framework schützt Apps und Desktop-Anwendungen, die auf unsicheren IT-Systemen von Endkunden laufen. CSF härtet Ihre Software und macht sie unempfindlich gegen Trojaner. Dadurch werden Ihre Geschäftsprozesse noch sicherer – auch auf potenziell kompromittierten Umgebungen.

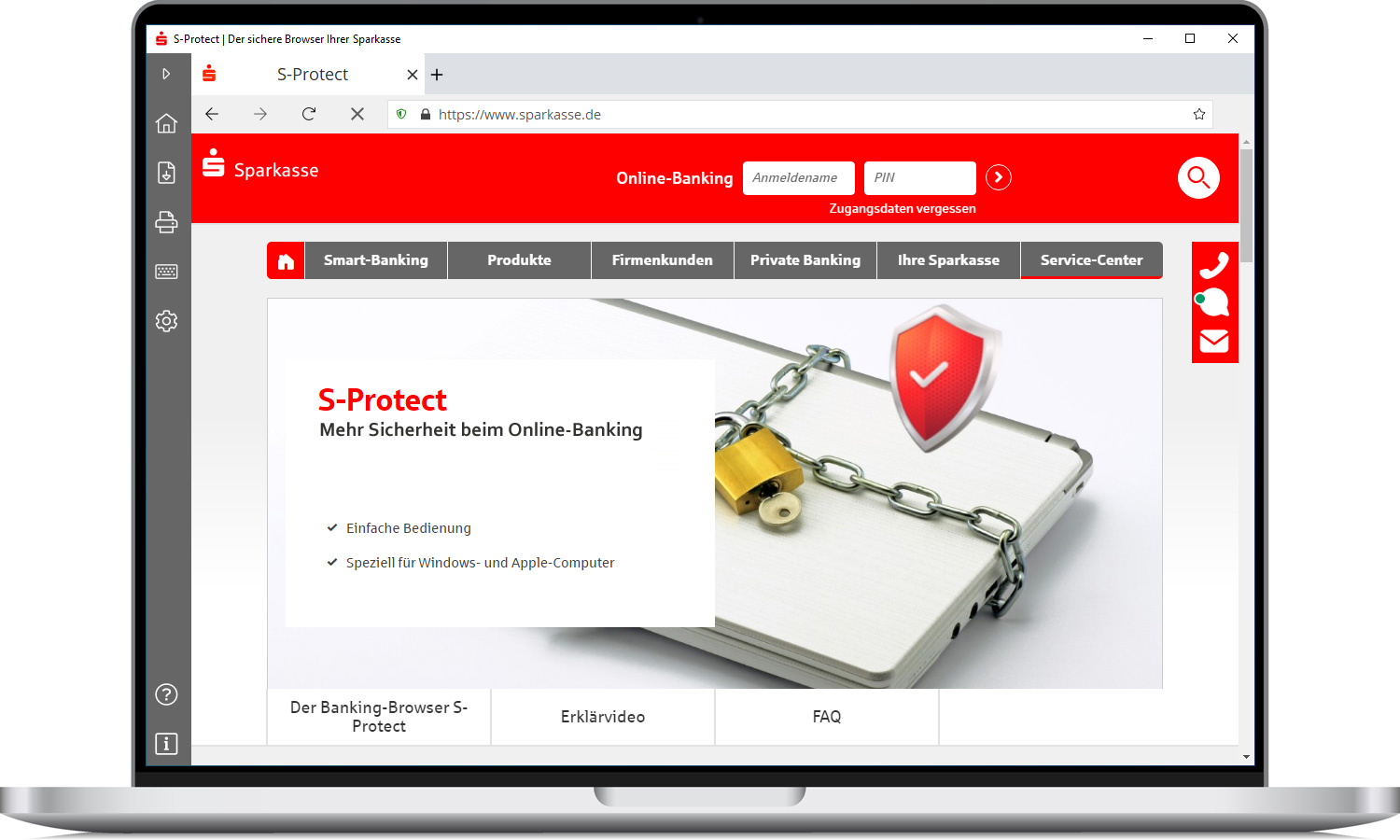

Der PROTECT Browser macht Online-Banking noch sicherer. Die Whitelist verhindert das Phishing-Seiten aufgerufen werden. Zusätzlich verfügt der Browser über Abwehrmechanismen gegen typische Banking-Trojaner. Banking und Payment werden so noch sicherer. PROTECT erlaubt Autologin ohne PIN-Eingabe und stellt RTS-konforme Besitzmerkmale für starke Kundenauthentifizierung (SCA) am Desktop.

Der VISOR Computercheck erkennt vollautomatisch Sicherheitsprobleme von Computer und Browser und unterstützt den Kunden diese Lücken wieder zu schließen. VISOR kann man sich am besten als eine Art Online-PC- und Smartphone-TÜV für technische Laien vorstellen. Weniger Fehler, weniger Phishing und weniger Supportaufwand für die Bank.

Internet Banking gibt es seit über 20 Jahren, stets mit einer Authentifizierung des Nutzers (Kontonummer & PIN) und Autorisierung der Transaktion (z. B. TAN).

Als primärer Kommunikationskanal werden Web- oder Mobilanwendungen eingesetzt (Überweisung), als zweiter Kanal haben sich spezielle Endgeräte (TAN-Generator, Secoder) oder ein Mobiltelefon für die Übermittlung der Transaktionsnummer (Autorisierung) etabliert.

Doch was ist mit Migration der Push-App auf ein neues Smartphone ohne ini-Brief von der Bank? Autorisierung über SmartWatch? Gleichzeitige Benachrichtigung auf Smartphone und Tablet? Direktfreigabe der Überweisung ganz ohne TAN?

Internet Banking gibt es seit über 20 Jahren, stets mit einer Authentifizierung des Nutzers (Kontonummer & PIN) und Autorisierung der Transaktion (z. B. TAN).

Als primärer Kommunikationskanal werden Web- oder Mobilanwendungen eingesetzt (Überweisung), als zweiter Kanal haben sich spezielle Endgeräte (TAN-Generator, Secoder) oder ein Mobiltelefon für die Übermittlung der Transaktionsnummer (Autorisierung) etabliert.

Doch was ist mit Migration der Push-App auf ein neues Smartphone ohne ini-Brief von der Bank? Autorisierung über SmartWatch? Gleichzeitige Benachrichtigung auf Smartphone und Tablet? Direktfreigabe der Überweisung ganz ohne TAN?

Internet Banking gibt es seit über 20 Jahren, stets mit einer Authentifizierung des Nutzers (Kontonummer & PIN) und Autorisierung der Transaktion (z. B. TAN).

Als primärer Kommunikationskanal werden Web- oder Mobilanwendungen eingesetzt (Überweisung), als zweiter Kanal haben sich spezielle Endgeräte (TAN-Generator, Secoder) oder ein Mobiltelefon für die Übermittlung der Transaktionsnummer (Autorisierung) etabliert.Doch was ist mit Migration der Push-App auf ein neues Smartphone ohne ini-Brief von der Bank? Autorisierung über SmartWatch? Gleichzeitige Benachrichtigung auf Smartphone und Tablet? Direktfreigabe der Überweisung ganz ohne TAN?

Mit PROTECT lässt sich die Sicherheit jeder Anwendung deutlich verbessern – auch wenn das Betriebssystem potenziell kompromittiert ist. Zusätzlich bietet PROTECT Authentifizierungsfunktionen, wie Autologin oder Strong Customer Authentification (SCA) auf dem Desktop.

Mit PROTECT lässt sich die Sicherheit jeder Anwendung deutlich verbessern – auch wenn das Betriebssystem potenziell kompromittiert ist. Zusätzlich bietet PROTECT Authentifizierungsfunktionen, wie Autologin oder Strong Customer Authentification (SCA) auf dem Desktop.

Trojaner, Phishing, Online-Betrug, viele Menschen haben Angst ihre Bankgeschäfte online zu erledigen. Wie aber kann man Online-Banking richtig sicher machen? Wie den Browser oder die Banking-App nachträglich härten und vor Angreifern schützen? Mit PROTECT lässt sich die Sicherheit jeder Anwendung deutlich verbessern – auch wenn das Betriebssystem potenziell kompromittiert ist. Zusätzlich bietet PROTECT Authentifizierungsfunktionen, wie Autologin oder Strong Customer Authentification (SCA) auf dem Desktop.